Lenders no longer offer “true” no doc mortgage loans in Texas for owner-occupied (primary or second) homes, because federal rules require them to verify a borrower’s repayment capability through valid documentation.

That said, flexible loan options are available if you have nontraditional income, you don’t fit conventional guidelines, or you don’t have standard income proof, like W-2s or pay stubs.

Read on to learn more about no doc mortgage loans and explore your options to secure financing in the Lone Star State.

What Are No Doc Mortgages?

Historically, no doc mortgage loans, also called no income verification or stated income mortgages, allowed homebuyers to declare income with little or no verification.

These loans include:

- Stated-Income, Stated-Assets (SISA) - The borrower states income and assets with no standard income proof.

- Stated-Income, Verified-Assets (SIVA) - The borrower declares income, and the lender documents the assets.

- No-Income, No-Assets (NINA) - The lender doesn’t gather any income or asset documents, often relying on credit and collateral.

- No-Income, No-Job, No-Assets (NINJA) - There’s no need to verify income, employment, or assets.

Before the 2007-2008 housing collapse in the United States, many lenders simply pulled credit, took the borrower’s word for how much they earned, and gave them money.

No doc loans spread widely before the subprime mortgage crisis. With loose lending practices, these loans heavily contributed to the housing market crash.

Lenient approvals of risky loans significantly inflated the housing boom and fueled defaults when payments increased and prices dropped.

One study revealed that many no doc borrowers lied about their incomes. Reports also documented the widespread income overstatement on stated income loans.

Since the global financial crisis, government agencies have enforced new regulations to ensure lenders approve loans only for creditworthy borrowers.

The Consumer Financial Protection Bureau (CFPB) implemented the Ability to Repay Rule, which requires lenders to obtain proper documentation to assess a borrower’s financial situation.

While true no doc loans for owner-occupied mortgages are off the table under the new federal rules, limited variants may be available in business-purpose or investor programs.

Key Takeaway: In the past, no doc mortgages allowed borrowers to avoid income verification and played a role in the 2007-2008 crash. Since then, updated rules require lenders to verify a borrower’s ability to repay, whether using traditional or alternative income proof.

Alternatives to No Doc Mortgage Loans in Texas

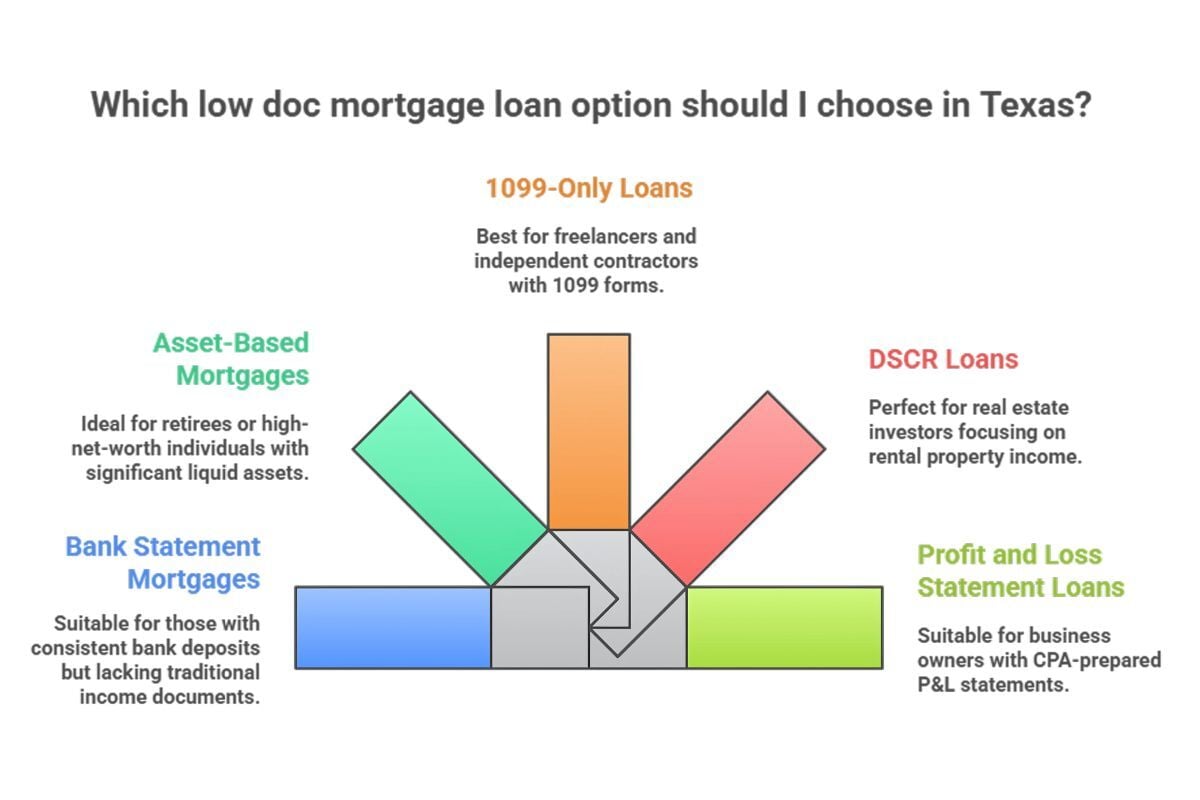

Today, lenders offer low doc mortgage loans while ensuring responsible lending practices.

Unlike years ago, when no income documentation was necessary, modern low doc loans require alternative income proof if you don’t have tax returns, W-2s, and pay stubs.

Here are several low doc loan options for a home purchase or refinance:

Bank Statement Mortgages

With bank statement loans, you qualify with personal or business bank deposits instead of tax returns. Lenders estimate your monthly income by averaging eligible deposits.

Requirements: 12-24 months of bank statements, proof of assets/reserves, and business documents if applicable

Asset-Based Mortgages

Lenders consider your liquid assets (savings and investments) to check your qualifying income. Asset-based mortgages are a good match for retirees and high-net-worth borrowers, like those living off investments.

Requirements: Statements for accounts and proof of access to funds

1099-Only Loans

Designed for freelancers and independent contractors, these loans rely on recent 1099 forms plus a reasonable expense factor for income verification.

Requirements: 12-24 months of 1099s, bank statements if necessary, and proof of current contracts

DSCR Loans (For Real Estate Investors)

For non-owner-occupied rentals, lenders calculate the debt service coverage ratio (DSCR) to verify your eligibility.

DSCR loans focus on the property’s ability to pay for itself rather than your personal income. Most programs target around 1.20 to 1.25 DSCR, often with 20% to 25% down payment and reserve requirements.

Requirements: Lease or market rent estimate, investment property appraisal with market rent schedule, proof of reserves, and credit and asset documents

Profit and Loss Statement Loans

Profit and loss statement loans mainly require 12-24 months of your business P&L and supporting bank statements.

Requirements: CPA-prepared P&L, recent bank statements to confirm your P&L numbers, business ownership proof

Who’s a Good Fit for Low Doc Loans in Texas?

Low doc mortgages work well for borrowers whose finances don’t fit standard lending guidelines.

Here are different types of borrowers that fit low doc loans:

|

Borrower Type

|

Recommended Loan Options

|

Why These Loans Are a Good Match

|

|

Self-employed professionals

|

Bank statement mortgage or P&L loan

|

Your deposits or current P&L show your true income instead of tax returns.

|

|

Business Owners

|

Bank statement mortgage or P&L loan

|

Gross deposits or business performance prove your ability to repay the loan when legal write-offs lower your taxable income.

|

|

Independent Contractors

|

1099-only loan or bank statement mortgage

|

Your 1099 totals or deposit history prove your income.

|

|

Freelancers

|

1099-only loan, bank statement mortgage, or P&L loan (if you keep books)

|

Lenders use alternative income proof to check your financial situation, even if you have variable income from multiple clients.

|

|

Retirees/High-Asset Borrowers

|

Asset-based mortgage

|

Your savings and investments are enough to prove your financial health when you have low taxable income.

|

|

Real Estate Investors

|

DSCR loans for rentals

|

Lenders consider your rental income to qualify you.

|

|

Other Borrowers With Nontraditional Or Complex Situations

|

Bank statement loans, asset-based programs

|

Lenders check your verified assets when you have irregular or hard-to-document income.

|

Pros and Cons of Low Doc Loans

Compare the benefits and drawbacks of no doc mortgages below to know if they’re a good fit for your financial situation:

Pros

- Alternative income documentation, so you don’t need W-2s or full tax returns

- Less paperwork (no W-2s and pay stubs)

- Faster approval

Cons

- Higher interest rates than conventional and FHA loans

- Higher credit score requirement

- Higher down payment (10% to 30% down payment range compared to conventional loans, which require only 3% dp for certain programs)

- Substantial liquid assets and ample income

- Limited availability

Should You Get a Low Doc Loan?

Low doc mortgages aren’t for everyone. Because of the higher rates and costs involved, consider these loans only if you don’t qualify for standard financing.

Be sure you have verifiable, sustainable income and you’re fully capable of making on-time payments without straining your budget.

Ready to take the next step toward homeownership? A trusted mortgage broker will shop around for loans to save you time and effort.

Work with one of our experienced loan officers at Texas United Mortgage to compare your home loan options, understand the requirements, and lock in a competitive offer.

Contact us today to start your application!

Next, learn everything you need to know about P&L loans in Texas with our quick guide.

Comments