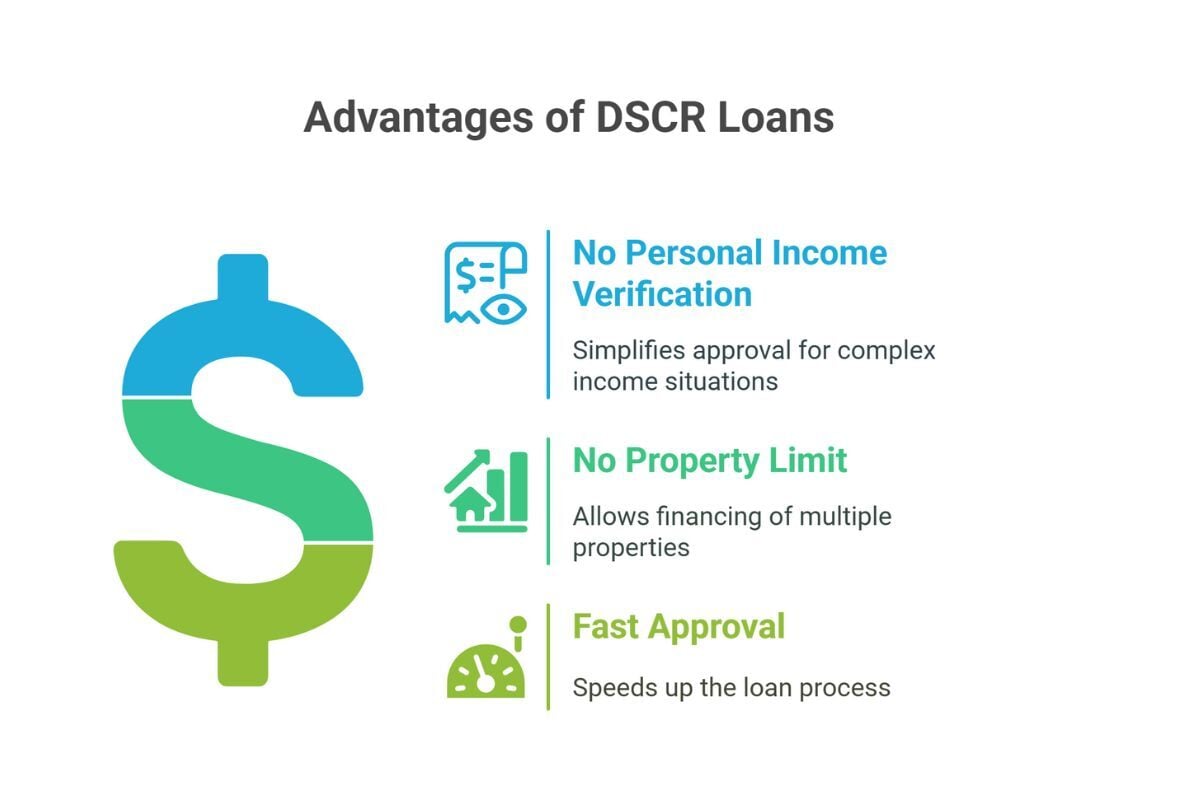

Debt Service Coverage Ratio (DSCR) loans skip personal income verification, allow financing of multiple properties, and close faster than traditional mortgages, offering flexibility and ease of transaction.

However, they come with higher interest rates, fees, and down payments.

Keep reading to understand the pros and cons of a DSCR loan in Texas and determine whether it fits your investment strategy and financial goals.

What is a DSCR Loan?

Designed for real estate investors, a DSCR loan focuses on an investment property’s debt service coverage ratio instead of your personal income.

Lenders review DSCR to see whether the investment property earns enough to pay its mortgage. Loan approval and terms heavily rely on the property’s cash flow.

They calculate DSCR as the property’s net operating income (NOI) divided by its total annual debt service (including all debt obligations).

- Most lenders require a 1.2 ratio, ideally 1.25 or higher, to qualify for a DSCR loan.

- With a 1.2 ratio, the property brings in 20% more income than your loan payments, giving you a safety margin. The 20% buffer helps absorb unexpected financial strain like vacancies or maintenance spikes, reducing the risk for lenders.

DSCR loans apply only to income-generating properties, not owner-occupied primary residences. Also, the property must be renter-ready, so fixer-uppers don’t qualify.

Key Takeaway: Lenders use DSCR to evaluate your ability to repay the debt through rental income without checking your personal earnings.

DSCR Loan Pros

DSCR loans are easily accessible to first-time and seasoned real estate investors in the United States.

RentRedi cofounder and CEO Ryan Barone notes that limited income or unsteady employment often prevents aspiring investors from securing conventional loans.

In these cases, DSCR loans are an excellent financing solution.

They offer these advantages:

No Personal Income Verification Required

Because approval depends on strong cash flow from the property, you don’t have to worry about the lender verifying your pay stubs, W-2s, or employment history. You also skip the hassle of providing piles of paperwork.

Most lenders will only ask for your bank statements to verify your reserves.

DSCR loans are a smart fit for:

- Borrowers with complex and hard-to-document income

- Investors whose numerous write-offs and business deductions lower their reported earnings

- Beginner real estate investors, especially newer LLCs, with not much property income yet for financing properties

No Property Limit

Unlike conforming traditional loans, which cap you at 10 single-family (1-to-4-unit) properties under Fannie Mae and Freddie Mac guidelines, DSCR loans let you finance as many income-earning properties as your cash flow supports.

Also, you can refinance your loan once it gains sufficient equity, so you can use the cash to buy more rental property.

Expand your portfolio even without paying down a previous loan, so growth never stops.

Applicable to Different Rental Types

Scale from a single rental to a whole portfolio, including:

- Single-family rentals

- Small multi-family homes (duplexes, triplexes, and fourplexes)

- Small apartment buildings (5 to 20 units, depending on the lender)

- Long-term leases or short-term/vacation rentals

Fast Approval

Approval moves from application to closing faster than traditional mortgages because the decision depends on the property’s DSCR rather than your personal finances.

Key Takeaway: DSCR loans simplify the application process for borrowers with complex or limited income and investors wanting to expand their portfolios. With the right ratio, lenders green-light loans so you don’t have to deal with lengthy income audits.

DSCR Loan Cons

Here are the drawbacks of DSCR loans:

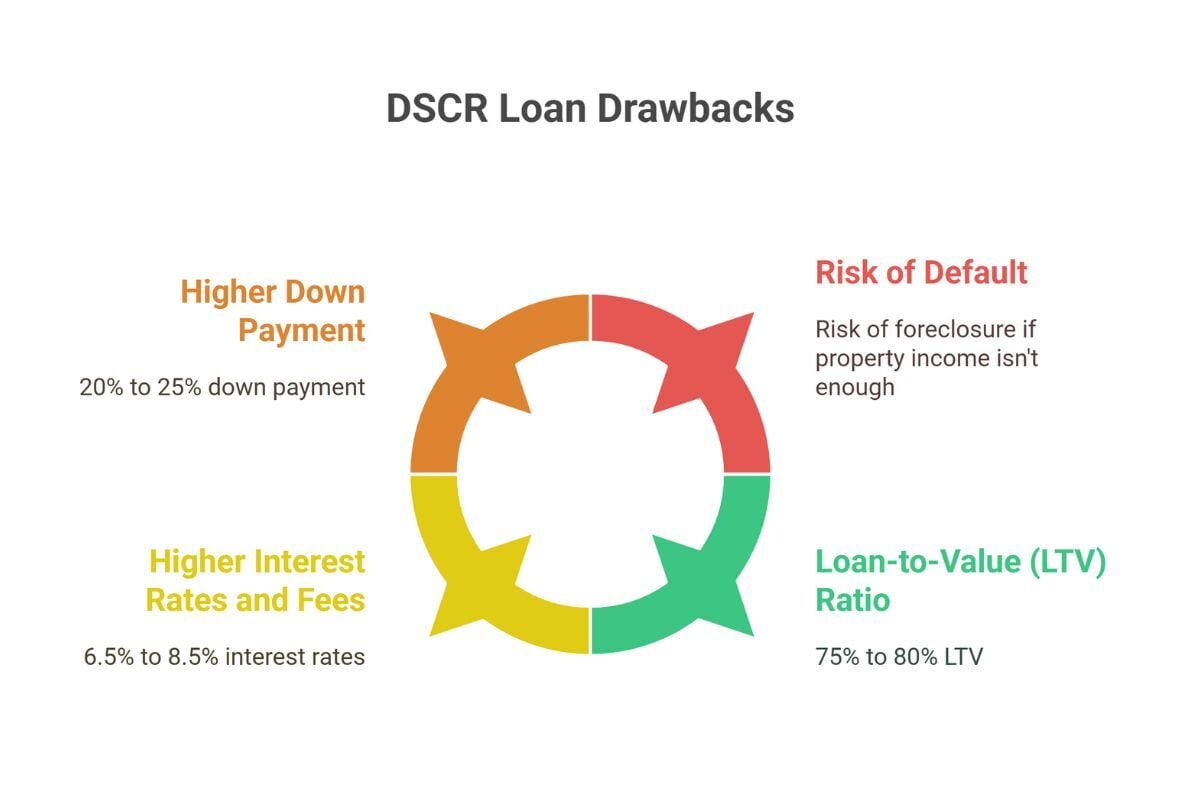

Higher Down Payment

Unlike conventional loans, which require down payments as low as 3%, most DSCR loans require a 20% to 25% down payment to reduce the risk. This can be challenging for investors who don’t have enough available funds.

Lenders may request a higher down payment (up to 30%) if the property has a weak DSCR or the borrower has a low credit score.

Higher Costs

DSCR loans often have higher mortgage interest rates and fees (underwriting, origination, and processing fees) than traditional loans, making financing more costly.

Interest rates range from 6.5% to 8.5%, roughly 1 to 2 percentage points above a conventional investment-property mortgage. Terms may be less favorable for borrowers with low credit scores.

Also, some lenders may charge prepayment penalties if you want to pay your loan early, as DSCR loans aren’t government-backed.

Pro Tip: Aim for a 740+ credit score and a strong DSCR to get the best loan terms. Review the terms of your loan agreement extensively to ensure you don’t miss crucial details like prepayment penalties.

Loan-to-Value (LTV) Ratio

Conventional loans allow up to 97% LTV. On the other hand, lenders offering DSCR loan programs usually approve 75% to 80% loan-to-value (LTV) with a qualifying DSCR.

That means you must pay the remaining amount as the down payment.

Risk of Default

If the property income isn’t enough, you could fail to pay your monthly mortgage, leading to foreclosure.

When this happens, you’ll lose your property and impact your financial standing.

Be sure to select properties with strong income-generation potential that meet lender requirements. Stay on top of property demand and market trends in Texas for a successful DSCR loan.

How We've Helped Real Estate Investors Through DSCR Loans

At Texas United Mortgage, we tailor financing solutions to every client’s goals.

Here’s how our loan officers made it possible for real estate investors to access equity-based cash.

An Investor’s Cash-Out Success: Cutting Taxes With a DSCR Loan Strategy

Reef Merhi, one of our loan officers, recently helped an investor beat the tax code using a DSCR loan.

The savvy investor reduced their taxable income by writing off everything they could that met tax-code requirements.

However, while this seems like a smart move for immediate tax savings, it becomes an obstacle when applying for traditional financing.

Why? Because the investor’s tax returns showed a smaller income after numerous deductions. Many lenders would have considered this a deal-breaker.

But not us! We saw an opportunity.

The client wanted a cash-out refinance. Reef proposed a DSCR loan, which the investor would qualify for as we don’t have to check your tax returns.

We assess your eligibility based on the property’s rental income, and that’s about it.

Here’s what happened:

- No Tax Documents: The investor didn’t have to submit any tax paperwork, just proof of current market rent and a verified lease.

- Smooth Transaction: The deal moved forward seamlessly since the market rent was enough to cover the new mortgage payment.

- Favorable Rates: The borrower secured top-tier rates and minimal fees by keeping the LTV below 70%. A low LTV means a bigger equity cushion and lower risk for the lender.

Key Takeaway: Even if you report low taxable income, you can still pull cash from your property using a DSCR loan. The rental cash flow is the key basis for qualification, not your personal tax returns.

Helping an Investor Save $6,000 in Upfront Fees and Secure a Lower Rate With a Smart Prepayment Move

I mentioned above that lenders usually charge prepayment penalties if you pay off the loan early, since DSCR loans are privately funded.

But there are cases where they can work in your favor.

In a recent deal we closed, the client wanted a $300,000 cash-out refinance on a $400,000 property. They received different rates, depending on how long they would keep the loan, whether for 1, 2, or 3 years before paying it off. The rates were stronger with longer commitment.

They had two options:

- Option 1: Pay $6,000 in upfront points on a $300,000 loan to unlock a better rate (6.49%).

- Option 2: Bundle those points into the rate structure and accept a 3-year prepayment penalty. This means they must only pay $6,000 if they pay the loan off within 3 years.

The second option made much more sense.

The standard rate is 6.99%. But if the client commits for 3 years, they wouldn’t have to pay the $6,000 fee while locking in a lower rate (6.49%), essentially a free rate reduction.

And even if they eventually decide to pay the loan off early, the $6,000 prepayment fee would simply be the same as the upfront fee.

Our rate buydown strategy works by rolling the $6,000 fee into the loan’s prepayment framework rather than paying cash at closing.

This structure is possible with non-owner-occupied loans, including DSCR, bank statement, and P&L-based loans.

Key Takeaway: If you’re an investor planning to hold the property for years, rolling the buydown cost into your loan’s prepayment terms will save you thousands upfront while securing a lower rate.

Grow Your Real Estate Investment Today

A DSCR loan is an excellent investment tool when you focus on properties with a strong cash flow.

It’s ideal for real estate investors who want less documentation and a smoother approval process, especially those who don’t qualify for traditional loans. Just make sure you have enough money to cover the down payment.

Take time to compare the pros and cons of a DSCR loan in Texas to make the right financial decision.

Need help deciding? Our mortgage experts are ready to help you choose the best financing option for your financial goals.

Reach out to us today to explore your options!

Next, discover whether no doc mortgage loans still exist in Texas today.

Comments