To qualify for a USDA loan in Texas with bad credit, you must demonstrate strong compensating factors, including solid cash reserves, steady employment, and a clean payment history.

Keep reading to understand USDA loans, know exactly how to improve your approval chances, and explore the eligibility requirements.

What Are USDA Loans?

USDA loans, also called Rural Development or RD loans, are government-backed home loans offering zero down payment to low- and moderate-income homebuyers in eligible rural and certain suburban areas. [1]

The U.S. Department of Agriculture (USDA) established the USDA Rural Development Guaranteed Housing Loan Program, which guarantees USDA loans to make homeownership more accessible for people facing financial challenges, especially first-time homebuyers.

- USDA Single Family Housing Guaranteed Loans (Section 502 Guaranteed): Approved mortgage lenders offer 30-year fixed-rate loans with up to 100% financing to qualified borrowers. [2]

- USDA Direct Loans (Section 502 Direct): USDA directly issues the loans, available to borrowers with low and very low incomes who don’t qualify for loans elsewhere. [3]

- USDA Repair Loans and Grants (Section 504 Home Repair): These are only for home repair, upgrade, and improvement projects. Homeowners aged 62 or older may receive grants to remove health and safety hazards, making their homes safer and more livable. [4]

What If I Have Bad Credit?

Getting your loan approved is possible even if you have a poor credit score.

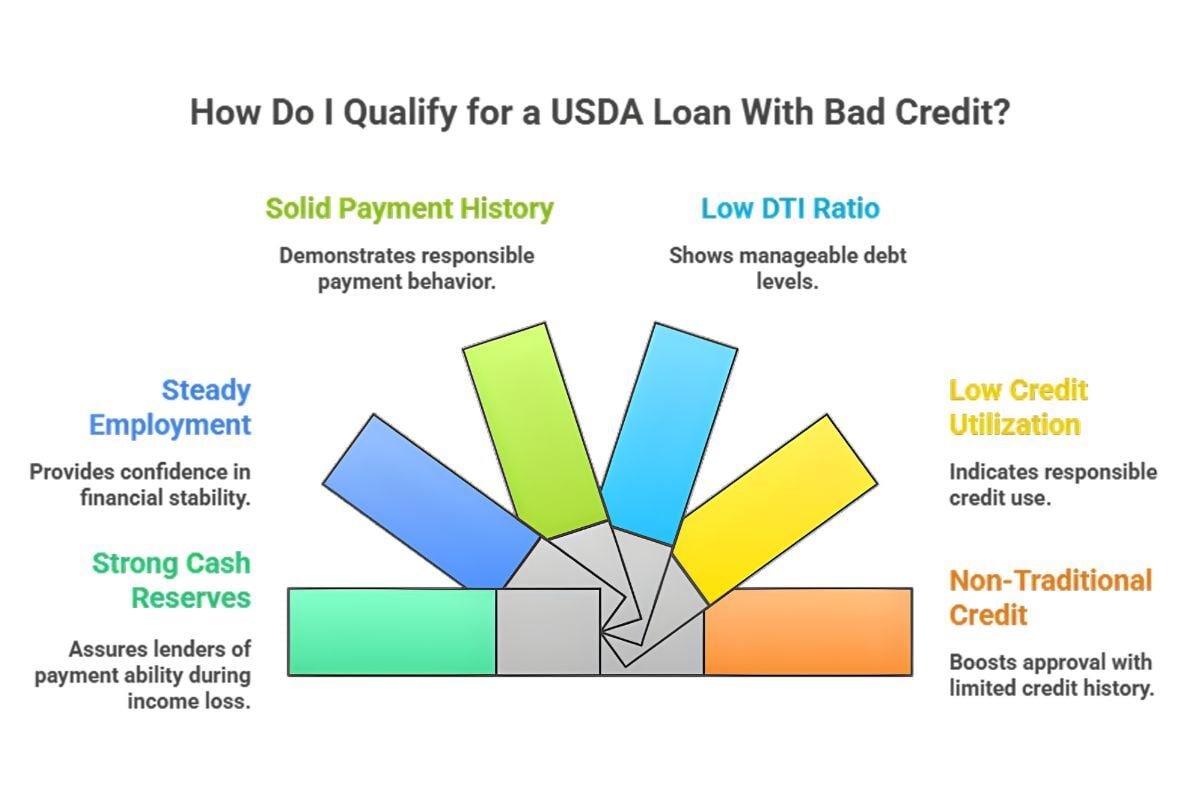

What you need to do is persuade lenders that you’re still a creditworthy borrower by showing these compensating factors:

- Strong cash reserves: These are easily accessible cash and assets, assuring the lender that you can still pay your loan in the event of income loss. Most lenders accept qualifying assets, such as checking accounts, savings accounts, money market accounts, certificates of deposit, stocks, and bonds. [5]

- Steady employment: With a consistent employment record, your lender feels more confident about your financial stability and ability to pay the loan.

- Solid payment history (12 months): Lenders will evaluate your income and cash flow to see if you can handle monthly payments responsibly. This means no late or missed payments, especially on rent payments and installment debts.

- Low debt-to-income (DTI) ratio: Your DTI ratio must not exceed 41%. Otherwise, you must have strong compensating factors, like substantial reserves.

- Low credit utilization: Under 30%, ideally below 10%, to demonstrate responsible credit use.

- Proof of non-traditional credit (if applicable): Record payments of phone and utility bills to boost your approval chances if you have limited credit history.

Pro Tip: If your credit score is on the lower side, partner with an experienced loan officer to better understand the requirements and improve your odds of approval.

Why Is My Credit Score Important?

While the USDA doesn’t require a particular minimum credit score, many USDA-participating lenders want to ensure that you’re capable and willing to repay the loan by reviewing your financial situation.

- The minimum credit score for automated underwriting is usually 640.

- If your credit score falls below this cutoff, your application will likely undergo manual underwriting, which takes longer and involves deeper scrutiny of your finances and credit history.

Your credit score doesn’t have to be perfect, but it helps to strengthen your position as a responsible borrower by demonstrating strong compensating factors.

If you have credit history issues, lenders will dig deeper into the reasons. For example, they may still approve your loan if a major medical expense impacted your credit, but you have a dependable job and your overall financial health is strong.

How to Boost Your Credit for a USDA Loan

It’s always possible to improve your current credit score, no matter how bad it is.

Before applying for a USDA loan, homeowner Kim Lawrence says that she worked hard to clean up her credit with help from Rural Development’s Native Relending program, as she had poor credit and unpaid loans. At 56, she successfully purchased her first home, where she now lives with her niece and nephew. [6]

Like Kim, you too can strengthen your credit and make homeownership a reality. Here’s how:

- Always pay your bills on time and in full. It’s best to set up automatic payments to avoid late or missed payments.

- Request free credit reports and dispute any errors or inaccuracies.

- Pay off your credit card debts to lower your credit utilization ratio.

- Focus on debts with the highest interest rates first and slowly work your way toward the smaller ones.

- Ask a trusted family member to add you as an authorized user on their credit card if they have a good payment history.

- Avoid applying for new credit cards and loans, which hurts your score.

- Avoid using cards for large purchases, like paying for an expensive vacation, before getting a loan.

- Think twice before cosigning someone’s loan, as this affects your DTI ratio. Lenders consider it an added financial responsibility, even if the original borrower makes on-time payments.

- Never neglect your debts. Ask your creditor for a payment plan if you have any recent account sent to collections, which can significantly impact your creditworthiness.

Complete Eligibility Requirements to Qualify for a USDA Loan

USDA loans come with:

- Zero down payment (if the sales price doesn’t exceed the appraised value)

- Low interest rates

- No private mortgage insurance

With more lenient credit standards and requirements than conventional loans, USDA loans make homeownership more attainable for people with imperfect credit.

However, you must still meet certain income and property eligibility requirements:

| |

USDA Guaranteed Loans

|

USDA Direct Loans

|

|

Minimum FICO Credit Score

|

No USDA-set minimum score, but most lenders require a 640 credit score. Some may accept a 620 score or lower, with strong compensating factors.

|

No fixed score

|

|

Maximum Debt-to-Income (DTI) Ratio

|

41%, but manual underwriting rules may allow higher DTIs with strong compensating factors

|

41%, but manual underwriting rules may allow higher DTIs with strong compensating factors

|

|

Maximum Loan to Value

|

100% of appraised value

|

Up to 100% of value, depending on underwriting

|

|

Private Mortgage Insurance

|

No PMI, but there’s a USDA upfront guarantee fee and an annual fee

|

No USDA guarantee or annual fees

|

|

Primary Residence Purchase

|

Yes

|

Yes

|

|

Income Limit Requirement

|

Up to 115% of area median income

|

Around 50% to 80% of area median income

|

|

Down Payment

|

0% down

|

0% down

|

|

Years Since Bankruptcy/Foreclosure/Short Sale

|

3 years (varies by lender)

|

Case-by-case, depending on the agency’s credit standards

|

You may check the full requirements for your chosen USDA loan program on the official USDA eligibility site.

Get Prequalified Today

Now that you know how to qualify for a USDA loan in Texas, take time to strengthen your financial situation and boost your approval chances.

Work with one of our trusted loan officers at Texas United Mortgage for personalized guidance, so there’s no guesswork when handling the requirements.

Ready to buy a home? Contact us today to start your USDA loan application!

Next, read our complete guide to know the common USDA income limits in Texas.

Sources:

[1] U.S. Department of Agriculture – USDA LINC Training: Loan Processing

[2] U.S. Department of Agriculture – Single Family Housing Guaranteed Loan Program

[3] U.S. Department of Agriculture – Single Family Housing Direct Home Loans

[4] National Council on Aging – What Is the USDA Single Family Housing Repair Loans and Grants Program?

[5] Zillow – What Are Cash Reserves?

[6] U.S. Department of Agriculture – Homeownership Becomes a Reality Through Four Bands Community Fund & Rural Development

Comments