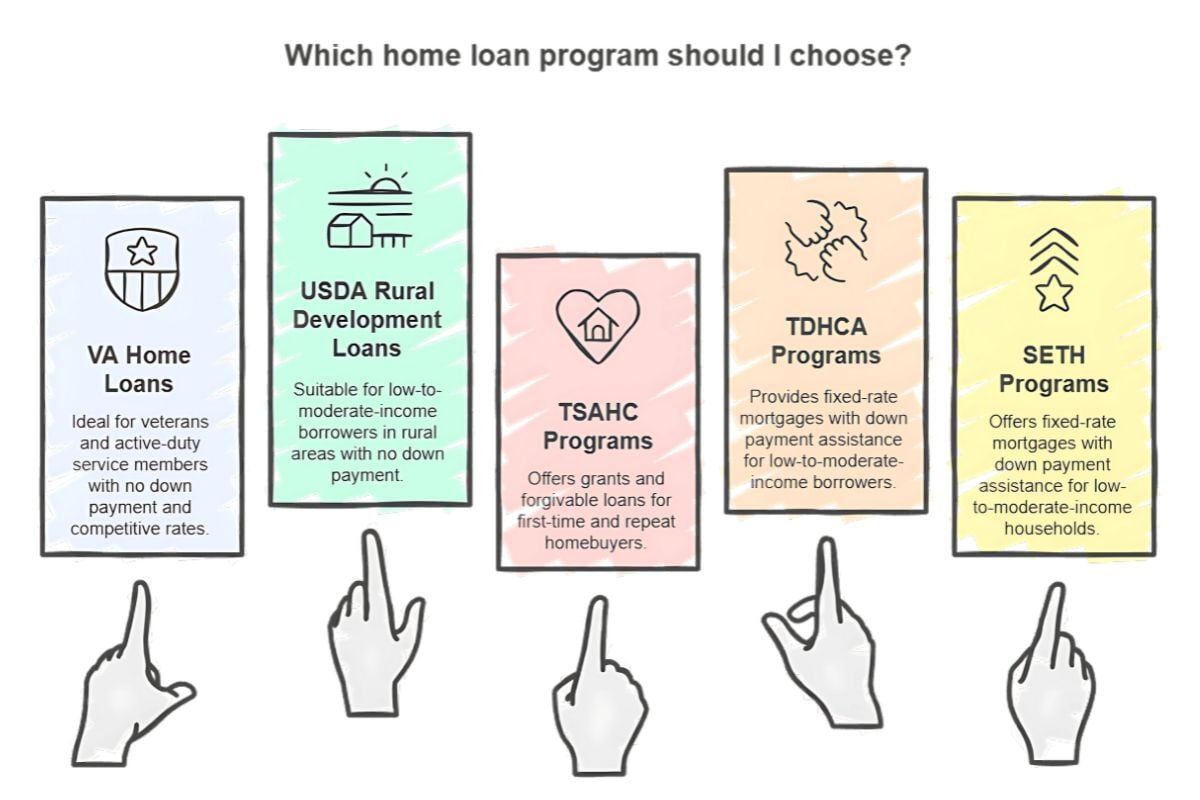

If you’re looking for Texas home loans with no down payment, consider government-backed loans such as VA Home Loans and USDA Rural Development Loans.

Down payment assistance programs are also available to make homeownership more affordable in the Lone Star State.

Continue reading to know your best options, whether you’re a first-time or repeat homebuyer.

Government-Backed $0 Down Loans for Texas Homebuyers

The upfront costs of buying a home are a heavy burden for many Texans. To help overcome this financial obstacle, the State of Texas offers these home loan programs:

VA Home Loans

Backed by the Department of Veterans Affairs, VA home loans make the path to homeownership easier for veterans, active-duty service members, and qualifying surviving spouses through a home loan guaranty benefit.

The guaranty minimizes risk for lenders, allowing them to give you a home loan with favorable terms.

Key features:

- No down payment (subject to lender appraisal value and overlays)

- No Private Mortgage Insurance (PMI), although you’ll have to pay a one-time VA funding fee

- Competitive interest rates

- Limited closing costs

- Lifetime benefit, which means you may use the guaranty more than once

To apply, you need a Certificate of Eligibility (COE) to obtain a VA loan through your chosen lender, and you must occupy your home as your primary residence.

Pro Tip: If you’re a Texas veteran, pair the Texas Vet Home Loan (VLB Veterans Housing Assistance Program) with a VA loan to access a lower, fixed rate for your home loan.

USDA Rural Development Loans

Backed by the United States Department of Agriculture, USDA Rural Development Loans provide affordable homeownership opportunities to low- and moderate-income borrowers in eligible rural areas.

Approved lenders provide full financing, thanks to the 90% Loan Note Guarantee the program offers to reduce lender risk.

Many Texas first-time homebuyers get the Single Family Housing Guaranteed Loan Program through private lenders. If you’re a very-low or low-income borrower, you may qualify for a USDA Direct Loan, provided by USDA itself.

Single-mother Kaitlyn, who once envisioned a comfortable home for her and her son, finally turned her homeownership dream into reality with the help of the USDA Section 502 Direct Loan Program. She moved from a small apartment to a warm, spacious home where her son, Tyrin, has lots of play space.

Kaitlyn’s story shows the importance of finding the right loan program that fits your financial situation and goals.

Here are the key features of USDA Rural Development Loans:

- No down payment

- No limit on gift funds

- No monthly PMI, but USDA charges a one-time guarantee fee (usually around 1% of the loan value) and an annual fee (paid monthly)

- No maximum purchase price

- Fixed, 30-year interest rates

You may apply for the program if your income doesn’t exceed 115% of the median household income in your area, and you will personally occupy the home as your primary residence.

Tx Down Payment Assistance Programs

Consider down payment assistance programs if you don’t qualify for VA Home Loans or USDA Rural Development Loans. Some of these programs also help cover closing costs.

Texas State Affordable Housing Corporation (TSAHC) Programs

With TSAHC’s down payment assistance, eligible first-time and repeat homebuyers get help in the form of a grant (no need for repayment if you don’t pay off or refinance the first lien in the first 6 months) or a deferred forgivable second lien loan (must be repaid in full only if you sell/refinance/pay off within 3 years).

- Homes for Texas Heroes Program - For people in hero professions, including professional educators, police/peace officers, firefighters, EMS personnel, veterans/active military, and certain nursing/allied health faculty

- Home Sweet Texas Home Loan Program - Ideal for low- to moderate-income Texas homebuyers who don’t have hero professions

Both programs offer 30-year fixed mortgages plus down payment assistance.

Pro Tip: If you’re a first-time buyer, apply for a Mortgage Credit Certificate (MCC) to obtain a yearly federal mortgage interest tax credit along with your loan.

Texas Department of Housing and Community Affairs (TDHCA) Programs

TDHCA helps low- and moderate-income borrowers become homeowners by providing 30-year fixed-rate first mortgages with up to 5% of the first lien mortgage amount, which you can use for down payment and closing costs.

Down payment assistance is available as a 30-year, 0% interest second lien or a 3-year forgivable second lien. You may also layer an MCC with your loan to save more.

- My First Texas Home (MFTH) - For first-time homebuyers and veterans

- My Choice Texas Home (MCTH) - For repeat buyers and veterans

Southeast Texas Housing Finance Corporation (SETH) Programs

Designed for low- to moderate-income applicants, SETH home assistance programs provide 30-year fixed-rate mortgages and up to 5% of the first-lien amount for down payment and closing costs.

You may choose between a 3-year forgivable second lien or a 30-year repayable second lien. Pair your loan with a SETH MCC to receive an annual federal tax credit.

- SETH 5 Star Texas Advantage and MyHome Plus Program - For first-time and repeat homebuyers

Private Lender Zero Down Programs

Some Texas credit unions and community banks require no down payment for home loans. They may use fixed or adjustable rates and cover part or all down payment costs with a grant, credit, or paired second lien.

Some lenders also waive private mortgage insurance (PMI), but the cost usually reflects in the interest rate instead.

While zero down programs by private lenders may offer faster closings, broader eligibility, and underwriting flexibility, they often involve higher rates or added fees. If there’s a monthly PMI, it increases your payment until you’ve reached around 20% equity.

Be sure to compare loan estimates plus loan limits, income caps, second-lien terms, and actual closing costs to determine whether these programs are a good fit for you.

Take the Next Step to Homeownership Today

Now that you know where to find Texas home loans with no down payment, the next step is to get pre-approved to see what you can afford.

Our experienced loan officers at Texas United Mortgage make the homebuying process seamless and provide expert guidance until closing. We’ll explain your mortgage options, eligibility requirements, and anything else you need to know to make a well-informed decision.

Reach out to us today to start your application!

If you want to learn more about down payment assistance programs, read our extensive homebuyer's guide.

Comments