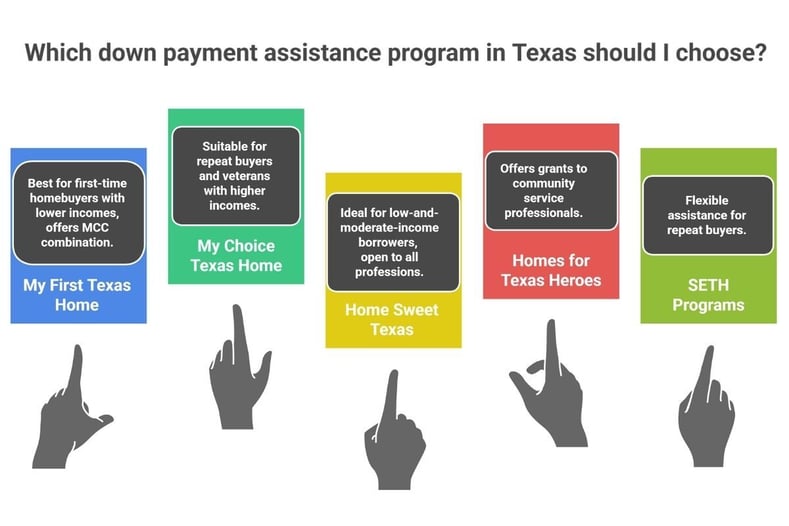

Homebuyers in Texas have access to several statewide down payment assistance programs, including TDHCA’s My First Texas Home and My Choice Texas Home and TSAHC’s Homes for Texas Heroes and Home Sweet Texas.

These programs offer assistance as a grant or a 0% interest second-lien loan to reduce your down payment and often closing costs as well. Some local programs also offer low-interest second liens.

Read on to understand how these programs work, weigh the benefits and requirements, and choose the right option for you.

Homebuyer Assistance Programs in Texas

Thousands of flexible down payment assistance programs are available in the U.S. to make homeownership more affordable, including federal, state, county, and city programs.

Here are several options for Texan homebuyers:

My Choice Texas Home and My First Texas Home

| |

Down Payment Assistance Details

|

Requirements

|

|

My Choice Texas Home

My First Texas Home

|

0% interest, 30-year deferred repayable second lien

3-year deferred forgivable second lien

|

620 min credit score

Meet income and property value limits (My First Texas Home)

No purchase price limits (My Choice Texas Home)

|

|

My Choice Texas Home (MCTH) is an excellent choice for repeat homebuyers and veterans, whereas My First Texas Home (MFTH) is available exclusively to first-time homebuyers (who have not owned a home in the last three years) and veterans.

My Choice Texas Home has higher income limits than My First Texas Home, making it a better fit for borrowers with higher incomes.

Both programs offer a 30-year, low-interest, fixed first mortgage plus up to 5% of the home loan amount to cover down payment and closing costs.

- Sponsored by the Texas Department of Housing and Community Affairs (TDHCA)

- Flexible assistance, between 2% and 5% of the loan amount

- 0% interest, 30-year deferred repayable second lien (no monthly payments; you repay the down payment assistance if you sell, refinance, or pay off the first mortgage; otherwise due at maturity)

- 3-year deferred forgivable second lien (no monthly payments; you don’t have to repay the balance if the home is still your primary residence after 3 years and you make on-time, full payments on your first mortgage)

TDHCA lets you combine your down payment assistance with a Mortgage Credit Certificate (MCC) through the My First Texas Combo option to maximize your homeownership savings.

Although take note that this doesn’t apply to My Choice Texas Home. (I’ll explain more about MCCs below.)

Here are some of the eligibility requirements:

- 620 minimum credit score

- Must live in the house as a primary residence within 60 days of closing

- Meet income and property value limits when applying for My First Texas Home; no purchase price limits when applying for My Choice Texas Home

- Complete a homebuyer education course

- Mortgage approval with a Texas Homebuyer Program-approved lender

Key Takeaway: Choose My First Texas Home if you’re a first-time buyer or a veteran. My Choice Texas Home suits you if you prefer no purchase price limit and you have a higher household income, whether you’re a repeat or first-time buyer.

Home Sweet Texas and Homes for Texas Heroes

| |

Down Payment Assistance Details

|

Requirements

|

|

Home Sweet Texas

Homes for Texas Heroes

|

Grant

0% deferred forgivable second lien

|

620 min credit score

Meet income and purchase limits

|

Home Sweet Texas makes homeownership easier for low- and moderate-income borrowers, and it’s open to any profession.

Homes for Texas Heroes is a special program for Texans who serve their communities, and it’s exclusive to specific professions.

- Sponsored by the Texas State Affordable Housing Corporation (TSAHC)

- Down payment assistance between 2% and 5% of the loan amount with a 30-year fixed first mortgage

- Offers assistance as a grant that you don’t have to repay as long as you don’t refinance or pay off the first mortgage within the first 6 months

- Offers assistance as a 0% interest deferred forgivable second lien loan that you must repay in full if you sell, transfer, refinance, or pay off the first lien within 3 years

Combine TSAHC’s down payment assistance with an MCC, if eligible, for more homeownership savings.

First-time and repeat homebuyers both qualify for Home Sweet Texas and Homes for Texas Heroes.

Edna and Bernardo, first-time homeowners in Dallas, secured over $11,000 for their FHA loan down payment through TSAHC’s Home Sweet Texas Program.

Here are some of the eligibility requirements:

- 620 minimum credit score; 640 for HFA conventional loans

- Meet income and purchase price limits

- Must live in an eligible property as your primary residence within 60 days of closing

- Complete a homebuyer education course

- Mortgage approval with a TSAHC-approved lender

Pro Tip: A forgivable second lien works best if you intend to keep the first mortgage and stay in your home throughout the forgiveness period. However, if you plan to move or refi sooner, consider grant options and check all repayment conditions before you commit.

Mortgage Credit Certificate (MCC) Program

An MCC is a nonrefundable federal income tax credit certificate provided to low-to-moderate-income borrowers to make homeownership more accessible.

With an MCC, you claim part of your annual mortgage interest as a tax credit, reducing your federal income taxes.

This tax credit lowers your IRS bill dollar for dollar. For example, with a 20% MCC rate and $6,000 in annual mortgage interest, your tax credit amounts to $1,200, which directly reduces your taxes.

An MCC also boosts your loan approval chances, as some lenders consider the tax credit when calculating your debt-to-income (DTI) ratio.

The IRS limits the maximum tax credit a borrower may take each year to $2,000 if your MCC credit rate is over 20%. You’ll receive the tax credit as long as you live in the home.

Most MCCs are for first-time buyers, although some programs extend eligibility to veterans and targeted areas.

If you’re eligible for an MCC, you may use it with TDHCA’s My First Texas Home Combo program or TSAHC’s down payment assistance.

Southeast Texas Housing Finance Corporation (SETH) 5 Star Texas Advantage and MyHome Plus

| |

Down Payment Assistance Details

|

Requirements

|

SETH 5 Star Texas Advantage

|

0% 3-year forgivable second lien

0% 30-year deferred repayable second lien

|

640 min FICO score (5 Star)

620 min FICO score (MyHome Plus)

Meet income limits

Repeat buyers allowed

No maximum sales price

|

|

SETH MyHome Plus

|

10-year forgivable Community Second Loan

|

The SETH 5 Star Texas Advantage Program and SETH MyHome Plus Program offer qualifying homebuyers up to 5% of the final loan amount as down payment and closing assistance through a second loan.

Various home loan options are available, including 30-year fixed FHA, VA, USDA, and conventional loans with multiple assistance structures. Assistance options may change daily depending on market conditions.

Assistance via the SETH 5 Star Texas Advantage Program comes in the form of:

- 0% interest, 3-year forgivable second lien (no monthly payments; fully forgiven after 3 years)

- 0% interest, 30-year deferred repayable second lien (available for FHA and conventional loans)

For the MyHome Plus Program, SETH provides assistance through:

- 10-year forgivable Community Second Loan (no monthly payments; fully forgiven after 10 years)

Pair any available MCC program with 5 Star Texas Advantage or MyHome Plus for more homeownership savings. SETH also allows standalone MCCs.

Eligibility requirements:

- 640 minimum FICO score (5 Star Texas Advantage); 620 minimum FICO score (MyHome Plus)

- Meet income limits

- Complete the SETH homebuyer education course

- No first-time homebuyer requirement

- No maximum sales price

These programs are available throughout Texas except the city limits of McKinney, Grand Prairie, El Paso, and Travis County.

Work With a Reputable Mortgage Lender to Lower Your Upfront Costs

With so many down payment assistance programs in Texas, it’s crucial to have a qualified mortgage lender by your side to help you make the right choice.

Remember, every program has its unique terms and requirements. Your income, credit history, employment history, and debt-to-income ratio all play a role in qualifying for down payment assistance.

At Texas United Mortgage, our experienced loan officers will review your finances, discuss your options, and guide you through every step from preapproval to closing.

Contact us now to schedule a consultation!

Comments