Designed for self-employed borrowers, a P&L loan is an alternative financing option that lets you qualify for a mortgage using your business profit and loss statements.

It bypasses traditional income verification, making it a good option when your income is hard to verify through tax returns or your standard income proof falls short.

In this guide, I’ll explain how P&L loans work, common requirements, and key pros and cons to simplify your homebuying process.

How Does a P&L Loan in Texas Work?

Self-employed earners without a steady income or clear employment history often find it hard to qualify for conventional mortgage loans.

You may have unique financial circumstances with varying income levels throughout the year, and your true income may not be reflected on your tax returns.

That’s where flexible mortgage programs help.

- P&L loans (also called profit and loss statement loans) make it possible for you to secure financing by demonstrating your income using your business P&L statements.

- Profit and loss statements give lenders a good idea of your company’s financial health by showing how much your business spends and earns over a particular period of time.

Instead of checking your tax returns, lenders review your business’ revenues, net deposits, and expenses through your P&L statements, often from the past one to two years, to determine your financial strength, repayment capacity, and qualifying loan amount.

Your P&L tells a story about your income. Do you have a dependable income stream? Does your business have enough profit to support your loan payments?

If you're a creditworthy borrower, lenders may offer tailored options to fit your financial situation, such as 1-year and 2-year profit & loss statement loans.

Key Takeaway: P&L loans offer a flexible financing solution for self-employed individuals/business owners who may not qualify for traditional loans. There’s no need for you to provide tax returns, W-2s, and pay stubs. Mortgage lenders only require your business profit and loss statements and supporting bank statements to verify your cash flow and ability to repay the loan.

Who Are P&L Loans Best Suited For?

P&L loans are a good match for:

- Business owners/self-employed earners with fluctuating or seasonal income

- Business owners/self-employed earners whose tax write-offs lower their reported income

- Entrepreneurs and business owners relying on income from their own company

- Freelancers and gig workers with changing income patterns

P&L Loan Requirements in the U.S.

Lenders typically offer P&L loans as non-QM (non-qualified mortgages), as these loans use alternative documentation to evaluate income.

Non-QM loans offer a path to homeownership for responsible borrowers who struggle to qualify for traditional mortgages.

These loans don’t meet the strict guidelines for qualified mortgages set by the Consumer Financial Protection Bureau (CFPB), allowing lenders to set their own rules with more flexible requirements when assessing applicants.

Here are the typical requirements for P&L loans, which vary depending on the lender:

- 2+ years self-employment/business ownership history

- 12 to 24 months profit and loss statements, prepared and signed by a CPA/licensed tax professional

- 2 to 3 months of bank statements (some programs waive bank statements at a lower loan-to-value (LTV) or with a higher down payment)

- 600 to 660 credit score, depending on the LTV and loan program

- 10% to 30% down payment

- Proof of business ownership

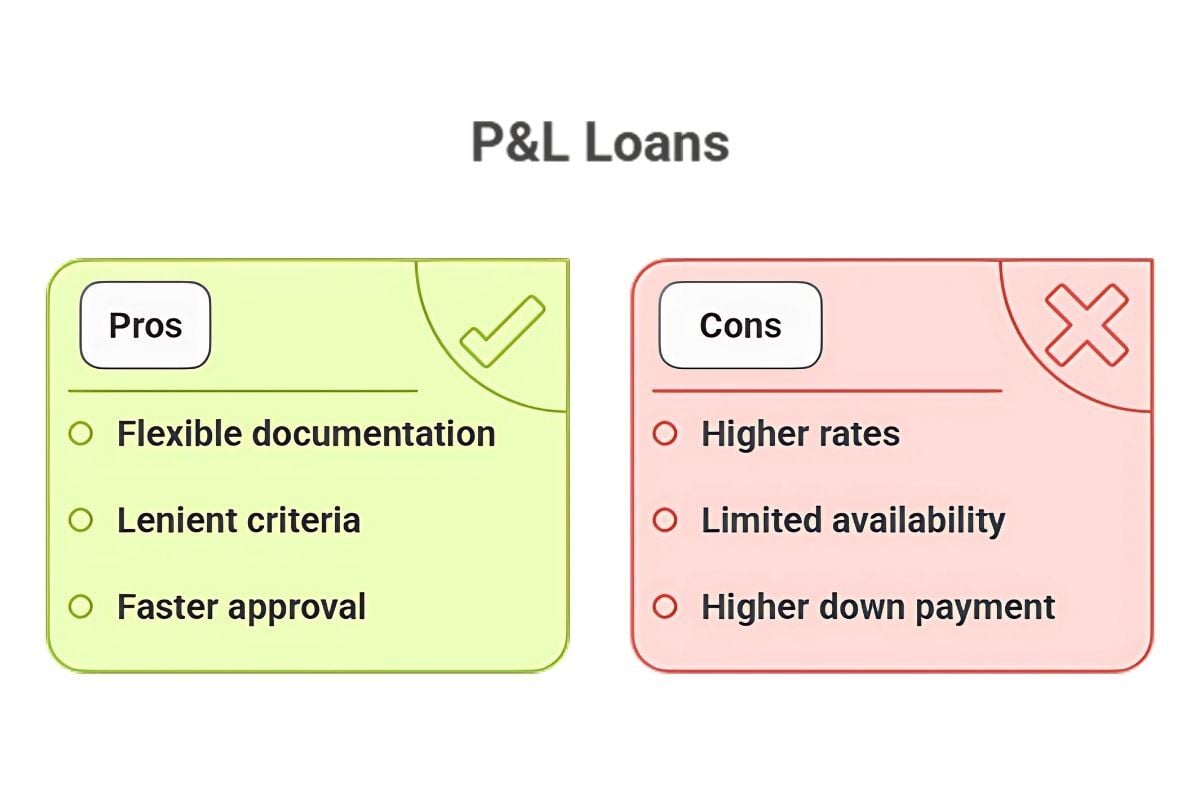

Pros and Cons of P&L Loans

Here are the advantages and drawbacks of P&L loans:

Pros:

- Flexible income documentation, requiring no tax returns or pay stubs

- Lenient eligibility criteria, catering to unique financial situations

- Lighter paperwork and faster approval than conventional mortgages

Cons:

- Slightly higher interest rates than traditional loans

- Limited availability as fewer lenders offer P&L loan programs

- Higher down payment requirement, varying by lender

Secure Financing With a P&L Loan

If you keep clean books and your recent profit and loss statements prove your income, a P&L loan in Texas may be a good fit for you.

Want to know more about flexible financing options? At Texas United Mortgage, our expert loan officers tailor solutions for every homebuyer. We’ll walk you through your options and get you pre-qualified.

Get in touch with us today to start your application!

Next, discover how to qualify using rental income through a DSCR loan, which suits real estate investors with income-generating properties.

Comments