A profit and loss statement (P&L), also called an income statement, summarizes your business income and expenses for a set period, often monthly, quarterly, or annually.

It reveals your bottom line, giving lenders insight into your financial performance and creditworthiness.

Keep reading to see a sample P&L and grab a free downloadable template to build your own. I’ll also walk you through the process step by step to create an accurate P&L.

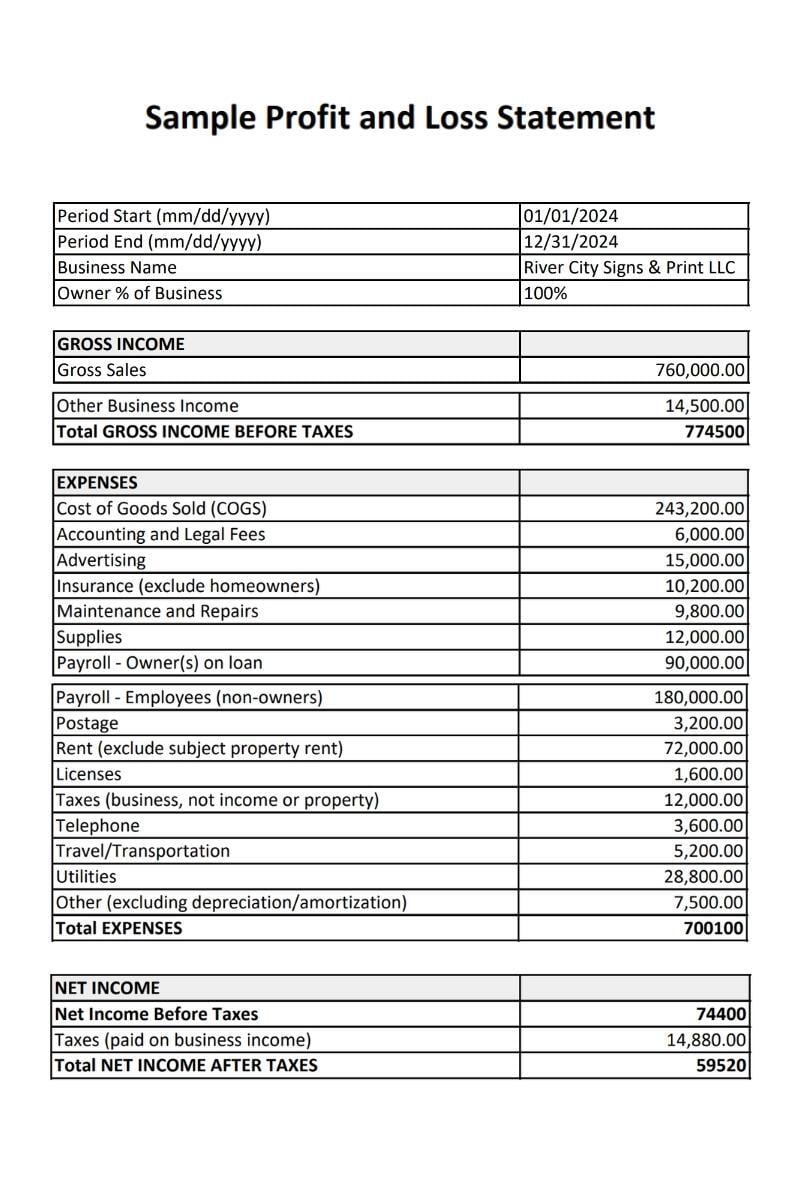

Example of Profit and Loss Statement for Loan Application

A P&L includes these key components:

- Revenue/Gross Income: Total money your business earns from sales/services

- Expenses: All costs required to run your business

- Net Income: Revenue minus expenses, indicating a profit or loss

Your profit and loss statement is a critical document when you’re applying for a P&L mortgage loan, which is a good match for self-employed borrowers (business owners/independent contractors/1099 contractors).

Here’s a sample P&L for a small-format print and design studio in Austin, TX.

The business has mild seasonality. Revenue is consistent enough to make a 12-month period appropriate.

I’ve used cash-basis accounting for simplicity, with non-cash items like depreciation excluded.

Downloadable Profit and Loss Template

Use my custom template below to generate your P&L in minutes. Simply open the file in Google Sheets or Excel, enter the amounts for your reporting period, and let the sheet handle the math.

For self-employed borrowers with service-based businesses, use Cost of Services instead of COGS and adjust expense categories to match your operations.

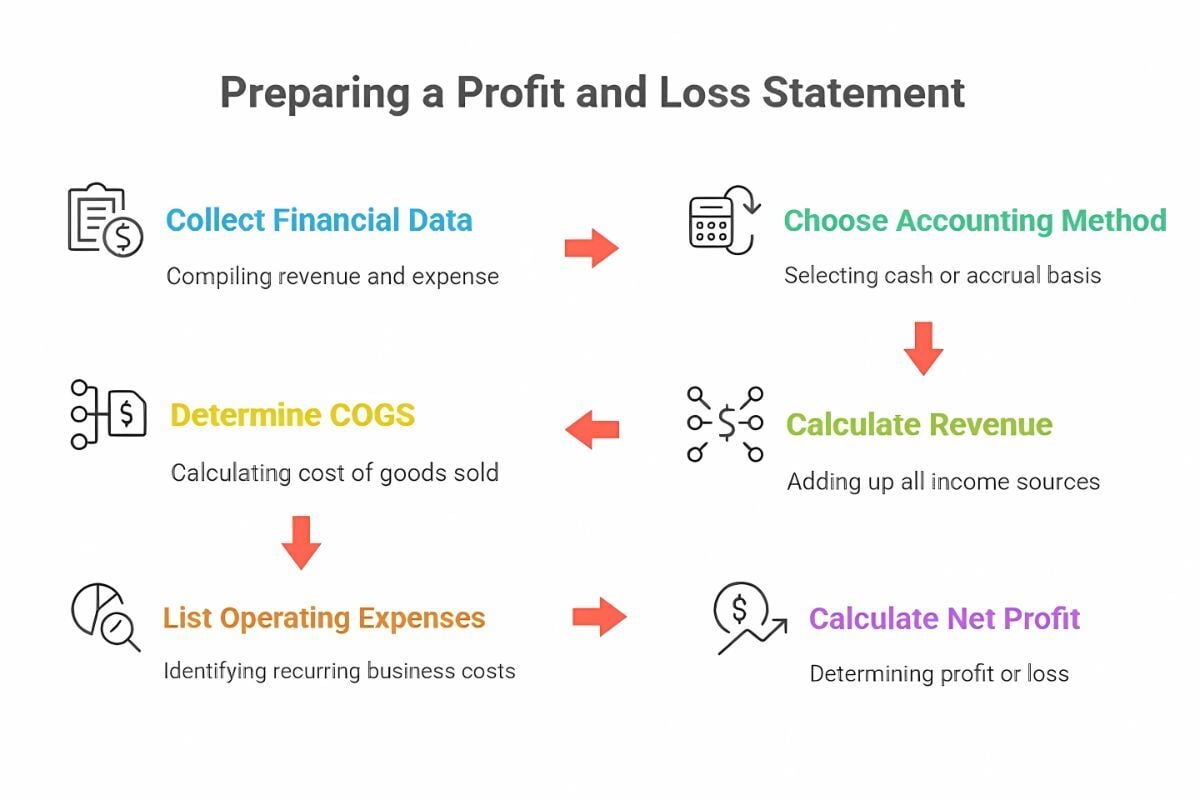

How to Prepare a Clear Profit and Loss Statement

Recording your revenue and expenses accurately is key to creating a reliable profit and loss statement.

Follow these steps to prepare your P&L:

1. Gather all essential financial information.

Collect all necessary documents, ensuring they cover every dollar earned and spent.

Compile these documents:

- All revenue records, including sales, service fees, rental income, and interest income

- All business expenses, from cost of materials and rent to salaries, utilities, and marketing

- Supporting documents, including contracts and invoices, 1099s, cash receipt logs, and business bank and credit card statements

Pro Tip: Have business bank statements ready to back up your P&L. Lenders may request them to confirm accurate and complete figures.

2. Select a reporting period and accounting method.

Choose the time period for your profit and loss statement. Lenders often request 12 to 24 months of P&L statements to evaluate income trends and stability, especially for seasonal businesses.

Then, pick your accounting method:

- Cash basis if you want to record income and expenses when money moves in or out

- Accrual method if you want to record income when earned and expenses when incurred, regardless of cash timing

Stick to your chosen method throughout the year for consistency, and be sure your bookkeeping and tax reporting use the same approach.

3. Calculate total revenue.

Gross income is your company’s total earnings before deducting expenses. Add up all revenue sources within the reporting period, including:

- Product sales or merchandise revenue

- Service fees

- Commissions

- Royalties

- Rental income

- Direct client payments

4. Add up the total Cost of Goods Sold (COGS) or Cost of Services.

Whether your business sells physical products or provides services with direct costs, your COGS may include:

- Raw materials and supplies

- Manufacturing expenses

- Direct labor

Calculate COGS by adding the beginning inventory and purchases. Then, subtract your ending inventory.

For example, River City Signs & Print starts the year with $38,500 inventory for vinyl, inks, banner media, and other materials. The company spends $225,700 on purchases during the year and ends with $21,000 in inventory.

The COGS then is: $38,500 + $225,700 − $21,000 = $243,200.

5. List your operating expenses.

Operating expenses refer to any business cost that’s not directly tied to producing goods or services. They are often recurring and essential to running the business.

Common operating expenses include:

- Rent or lease payments

- Advertising/marketing costs

- Office and business supplies

- Utilities

- Transportation

- Insurance premiums

- Professional fees (legal, accounting, consulting)

- Online tools and subscriptions

6. Determine your company’s net profit/loss.

Finally, deduct the total expenses from your gross income to calculate your net income. Then, subtract your business taxes to reveal your profit or loss.

Net profit is a critical figure that measures business performance. Lenders look for a steady positive net profit, which demonstrates financial strength and a strong capability to repay the loan.

After completing your P&L, be sure to sign and date it, preferably close to the note date, so lenders know who prepared it and when.

Create a Well-Structured P&L to Qualify for a Mortgage Loan

A carefully prepared profit and loss statement for loan application boosts your chances of approval.

If you’re running a profitable business and you’re creditworthy, you may qualify for a mortgage even without providing tax returns. Just be sure to submit accurate financial statements and follow all lender requirements to speed up verification.

Have questions about the right mortgage option for you? Our seasoned loan officers at Texas United Mortgage have helped numerous self-employed homebuyers secure financing in the U.S. We’ll review your financial profile and guide you toward preapproval.

Get in touch with us today for personalized support!

Next, find out whether no doc mortgage loans are still available in Texas today.

Comments