As a Texas homeowner, you have the right to obtain coverage without unfair discrimination by insurers. Your insurance provider also must charge fair and reasonable rates, handle claims promptly, and avoid deceptive practices.

Keep reading to understand important homeowners insurance laws in the Lone Star State. Knowing these rules will help you make better decisions before finalizing your mortgage.

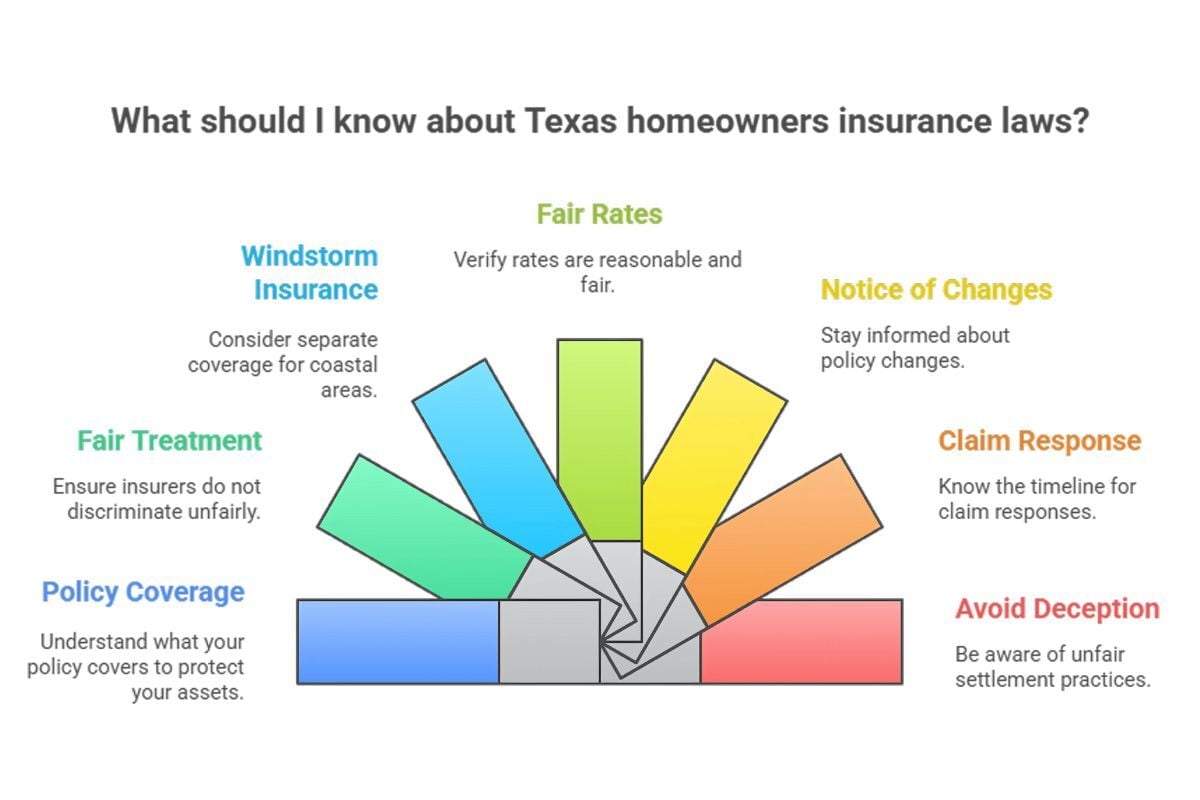

Key Texas Homeowners Insurance Laws to Know Before Buying Insurance

Texas law protects homeowners like you by defining your rights and setting strict rules for insurers.

Here are essential rules you should know before signing your policy:

1. Getting home insurance is not mandatory, but most lenders require it.

In Texas, you’re not legally mandated to get a homeowners insurance policy. However, if you finance your home, your mortgage lender will require coverage to protect the loan’s collateral.

Remember, home insurance safeguards your assets against various risks, such as theft, fire, windstorm, hurricane, or hail.

Pro Tip: Review your policy thoroughly to ensure you understand exactly what it covers and what you must do to file a claim. Read the Consumer Bill of Rights to know all your rights as a Texas policyholder.

2. Lenders cannot unfairly discriminate against you in underwriting, rates, or credit use.

Insurers must be fair to all homeowners seeking coverage.

They can’t turn you down, limit benefits, or charge higher rates because of your:

- National origin, religion, race, or color

- Location, marital status, age, or gender

- Disability

Also, insurers cannot deny, cancel, or refuse to renew your personal insurance policy based only on your credit score. Texas law requires them to consider other underwriting factors not tied to your credit score.

3. You may get a separate windstorm and hail insurance policy.

Some parts of Texas, especially along the Gulf Coast, are vulnerable to extreme weather. If you live in these areas, you may get windstorm and hail coverage separately.

If your insurer won’t cover wind and hail, the Texas Windstorm Insurance Association (TWIA) offers last-resort coverage for eligible properties in designated coastal areas.

Pro Tip: If you live along the Texas coast, find out if you’re eligible for TWIA coverage early, as underwriting and inspection may take time.

4. Insurance companies must charge fair, reasonable, and adequate rates for covered risks.

If an insurer charges excessive rates, the Texas Department of Insurance (TDI) will require the company to refund any overcharged premiums to policyholders.

Insurance companies often consider the following factors when determining your premium:

- Your home’s age, condition, and replacement cost

- Construction material type (brick/stone houses lead to lower premiums than wood homes)

- Your location

- Local fire protection availability

- Your credit score

- Your claims history

Pro Tip: Get a free copy of your Comprehensive Loss Underwriting Exchange (CLUE) report to review your claims history and check for errors. Report any wrong information as it could affect your premium.

5. Insurers must provide proper notice of nonrenewal changes.

If your insurer chooses to discontinue your policy after the end date, you have the right to know the reason for nonrenewal.

Pro Tip: Check your insurer’s policy for renewal rate increases. They may be required to give you a written notice if they raise the premium by a certain percentage to give you enough time to shop quotes, compare options, or ask for discounts.

6. Insurance companies must handle claims on strict deadlines.

Texas law requires insurers to notify you and review your claim before certain deadlines.

After you file a claim, your insurer must:

- Acknowledge the claim, start investigating, and request necessary items within 15 days

- Accept or deny it within 15 business days after receiving all requested information. If there’s any delay, the insurance company should let you know why (maximum 45 more days).

- Pay within 5 business days after approving your claim. Interest penalties apply for late payment (maximum 60 days delay, starting from when the company received all items).

Pro Tip: Ask help from a licensed public insurance adjuster if you need unbiased assistance when negotiating a complex claim. However, you’ll pay for their services so be sure to know the fees involved.

7. Insurance companies must avoid unfair settlement practices and deceptive practices.

It’s illegal for insurance companies and certain agents or adjusters to misrepresent policy terms, handle claims improperly, and employ other unfair or deceptive tactics.

Any knowingly committed violation may result in up to three times compensation, covering actual damages plus court costs and attorney’s fees.

The TDI reports that homeowners filed complaints last year about insurers requiring them to bundle their home and car insurance policies to renew a home policy.

Don’t hesitate to file a complaint with TDI through their Online Complaint Portal if you’re experiencing a problem with your policy.

Know Your Rights as a Policyholder in the U.S.

By knowing key Texas homeowners insurance laws, you protect your personal property and shield yourself from bad-faith insurance practices.

If you need help understanding lender guidelines, our seasoned loan officers at Texas United Mortgage will explain insurance requirements and ensure your policy meets lender rules so your closing stays on track.

Get in touch with us, and we’ll guide you through it step by step!

Comments