A Texas cash out refinance 50a6, also called a Texas A6 loan or Section 50(a)(6) loan, lets you borrow against your home’s equity by replacing your existing mortgage with a larger loan. You receive the difference between the two loans as a lump sum payment.

Keep reading to learn everything you should know about the key rules, requirements, and right timing for a Texas cash out refinance.

Understanding Texas 50(a)(6) Cash Out Refinance

Here’s how a Texas cash out loan works:

🠊 You refinance your primary residence to tap its equity.

🠊 Your remaining home equity decreases by the amount you’re pulling out.

🠊 You get the lump sum payment at closing.

🠊 You make one monthly payment on the new, larger mortgage, often at a lower interest rate.

You finally open your home’s piggy bank, and you can do anything you want with the coins.

- Consolidate high-interest debts, including personal loans, credit card debts, or medical bills, to roll bills into one simple payment.

- Secure a lower interest rate to lower your monthly payment.

- Fund major home improvements, from kitchen remodels to bathroom additions.

- Explore investment opportunities, such as a rental property or a startup business.

- Cover college tuition, graduate school, or other education expenses.

- Finance a major life event, like a wedding or celebration.

For example, a homeowner has a property valued at $450,000 and a $300,000 mortgage balance.

They refinance 80% of the home’s value ($360,000) and receive $60,000 in cash (the difference between the new and old loans). The remaining equity is $90,000.

Pro Tip: Choose trustworthy lenders familiar with Texas-specific cashout refinancing rules to ensure full compliance and lock in the most competitive interest rate with favorable loan terms.

Which Loan Types Are Eligible Under Texas Section 50a6?

The following qualify as Texas Section 50a6 loans:

- First-lien mortgages only

- Fixed-rate loans or 5, 7, 10-year Adjustable Rate Mortgage (ARM) plans

- No temporary rate buydown loans

- No subordinate liens

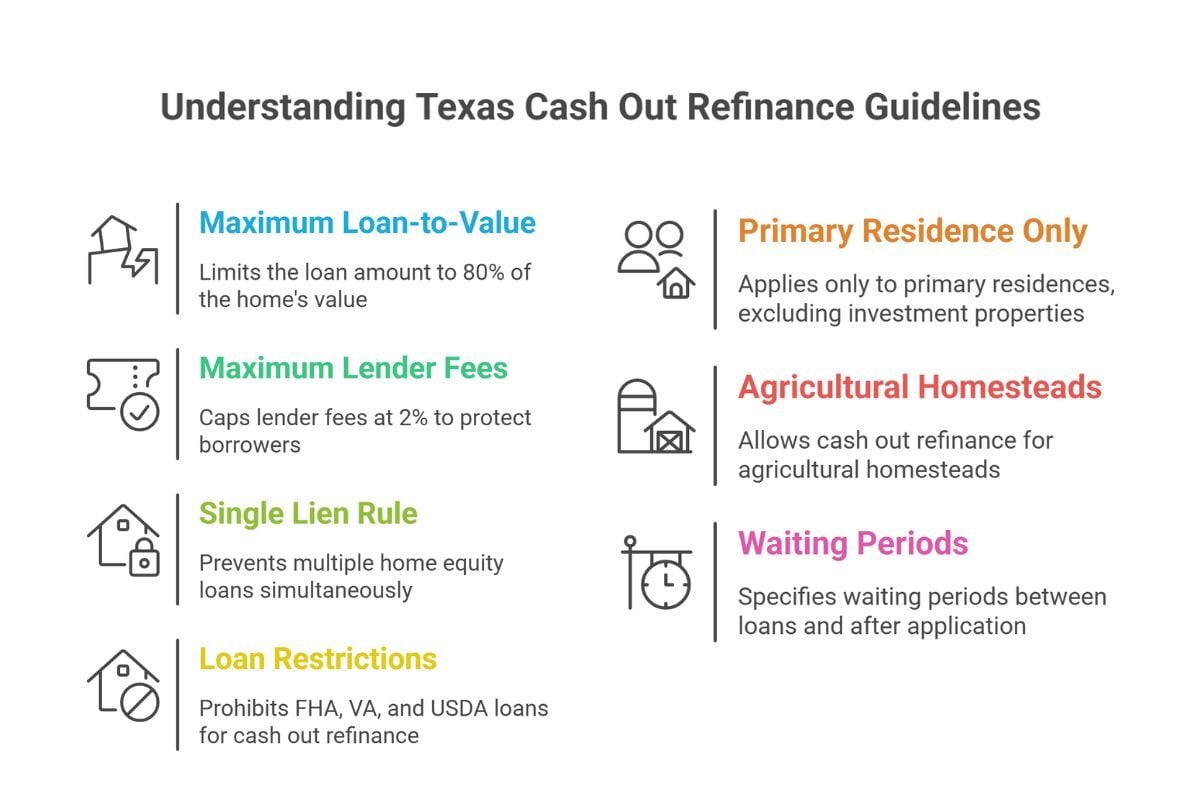

Texas Cash Out Refinance Guidelines

The Texas Constitution protects homeowners with strict rules and regulations, ensuring they stay financially secure and safeguard their home equity for the long term.

80% Maximum Combined Loan-to-Value (CLTV)

According to Article XVI, Section 50(a)(6) of the Texas Constitution, the sum of your new cash out loan and any current mortgage liens may not exceed 80% of your primary home’s value.

This rule preserves a minimum of 20% equity in your property to ensure you don’t acquire too much debt and lose your home.

2% Maximum Lender Fees

Previously, the max closing costs were 3% of the loan amount before the Texas Constitution was amended in 2017.

Today, the max closing fees (lender-charged) are 2%, including origination, underwriting, and credit report fees.

This rule protects borrowers from excessive upfront costs, making refinancing more accessible.

However, the cap doesn’t apply to third-party closing costs, such as attorney fees, appraisal and survey costs, and title insurance premiums.

One Home Equity Loan at a Time

Unlike most other U.S. states, Texas doesn’t allow homeowners to have a second-lien home equity loan if they have another Section 50(a)(6) loan.

The single-lien rule helps prevent over-leveraging, ensuring homeowners can’t take out multiple equity loans or lines of credit that could increase the risk of foreclosure.

This restriction applies to cash out refinances, home equity lines of credit (HELOCs), and closed-end home equity loans.

Clear current liens before refinancing:

- Pay off all existing liens before closing a new cash out refi.

- Private mortgage lenders often require that you clear all outstanding liens, including tax liens, second mortgages, HELOCs, judgment liens, contractors’ liens, and homeowners’ association liens.

No FHA, VA, and USDA Loans

You may not use any government-backed mortgage (USDA and VA loans) as a Section 50(a)(6) refinance, as federal guidelines don’t allow cash out advances and lien subordination.

Cash Out Refinancing for Primary Residence Only

The Texas 50(a)(6) rules apply only to your primary residence.

Texas law prohibits cash out refinancing for secondary homes and investment properties. Also, properties with 2 to 4 units don’t qualify.

Agricultural Homesteads Are Eligible

Agricultural homesteads, whether a small family farm or a bigger ranch you occupy as your primary residence, now qualify for a cash out refinance.

- Investment properties do not qualify.

- You may designate up to 200 contiguous acres for a family homestead and up to 100 acres for a single adult.

For example, a Texas rancher with a 160-acre family homestead valued at $625,000 and a $450,000 mortgage balance decided to refinance 80% of the property’s appraised value, $500,000 in total.

After replacing the old loan, they pulled out $50,000 in cash for equipment upgrades and repairs while having a remaining $125,000 equity after closing.

Waiting Periods

Keep in mind these waiting periods when planning your cash out loan:

- Once you close your original loan, lenders usually require that you wait 6 months before refinancing.

- You may get another cash out refi 12 months after your last one. Borrowers may refinance as many times as they want with a 1-year gap between loans.

- After sending your application, you must wait 12 days to close the loan and sign the disclosure within this period. The disclosure tells you all the rules involving a Texas cash out refinance 50a6 loan. A responsible lender will promptly send this 12-day letter to avoid closing delays.

- Under Fannie Mae/Freddie Mac guidelines, you must wait 12 months after a bankruptcy or foreclosure before applying for a cash out refinance. Some lenders extend the waiting period to 4 years following a bankruptcy or short sale and 7 years post-foreclosure.

Key Requirements for a Cash Out Refinance in Texas

Be sure you meet these requirements before planning a cash out refinance:

✅ 620 minimum credit score - The higher your credit score, the better the rates and terms.

✅ Up to 45% debt-to-income (DTI) ratio - Calculate your DTI by dividing your monthly debt payments by your monthly income and multiplying by 100. For example: ($2,000/$6,000) x 100 = 33% DTI

✅ 20% minimum equity after refinancing - You’ll likely secure better rates with a 75% LTV or lower.

✅ Owner-occupied single-unit principal residence - You must live in your home and not use it as an income-earning property.

Pro Tip: Check your credit report for inaccuracies and dispute any errors before applying for refinancing. Settle large debts, reduce high credit card balances, avoid missed or late payments, and limit new credit inquiries to strengthen your credit score.

Turn Your Home Equity Into a Financial Opportunity

With thorough planning and proper guidance, you can convert built-up equity into easily accessible funding for your financial goals.

Take time to review the Texas cash out refinance 50a6 rules above for a seamless process.

Our experienced loan officers at Texas United Mortgage will help you understand your refinancing options and answer all your questions every step of the way.

Contact us today to get personalized guidance from application to closing!

Comments